Browsing the Complexities of Pay-roll Compliance: Just How Professional Provider Ensure Regulatory Adherence

Expert services specializing in payroll compliance use a sign of advice via this maze of intricacies, giving a guard against potential violations and penalties. By turning over the ins and outs of payroll conformity to these specialists, organizations can browse the governing surface with self-confidence and precision, safeguarding their procedures and ensuring economic integrity.

Importance of Governing Compliance

Guaranteeing regulatory conformity is paramount for specialist solutions organizations to maintain functional honesty and minimize lawful risks. Complying with regulations stated by regulating bodies is not merely a box-ticking workout; it is a basic element of maintaining the trustworthiness and trust fund that clients place in these companies. Failure to abide with regulative requirements can cause serious consequences, consisting of financial fines, reputational damages, and even lawful action. Specialist services companies run in a complicated landscape where laws and laws are regularly developing, making it necessary for them to remain abreast of any modifications and guarantee their methods remain certified.

Knowledge in Tax Obligation Rules

Effectiveness in navigating elaborate tax obligation regulations is vital for specialist services organizations to maintain financial compliance and maintain honest standards. Provided the ever-evolving nature of tax laws, remaining abreast of adjustments at the government, state, and neighborhood degrees is paramount. Specialist companies need to have a deep understanding of tax obligation codes, reductions, credit reports, and conformity demands to make certain exact economic coverage and tax obligation filing. By leveraging their know-how in tax obligation laws, these companies can assist clients reduce tax liabilities while preventing costly penalties and audits.

Monitoring Labor Laws Updates

Staying informed about the most current updates in labor regulations is essential for expert services organizations to ensure conformity and minimize threats. As labor laws are subject to regular modifications at the federal, state, and local degrees, following these growths is important to avoid lawful problems or prospective penalties - Best payroll services in Singapore. Professional solutions firms should establish robust mechanisms to monitor labor regulations updates successfully

One way for organizations to remain notified is by registering for e-newsletters or informs from appropriate federal government firms, market organizations, or legal professionals specializing in labor regulation. These sources can offer prompt notices concerning new laws, changes, or court rulings that might impact pay-roll conformity.

In addition, expert services companies can leverage pay-roll software remedies that provide automatic updates to guarantee that their systems are straightened with the most recent labor laws. Routine training sessions for human resources and payroll team on current legal adjustments can likewise boost awareness and understanding within the company.

Minimizing Compliance Risks

Furthermore, staying notified regarding regulative modifications is vital for lessening conformity threats. Specialist solutions companies must continuously keep track of updates to labor laws, tax guidelines, and reporting demands. This positive method makes sure that payroll procedures continue to be certified with the current lawful requirements.

Furthermore, purchasing employee training on conformity matters can enhance awareness and reduce mistakes. By enlightening personnel on relevant read review legislations, guidelines, and best practices, companies can cultivate a society of compliance and minimize the likelihood of violations.

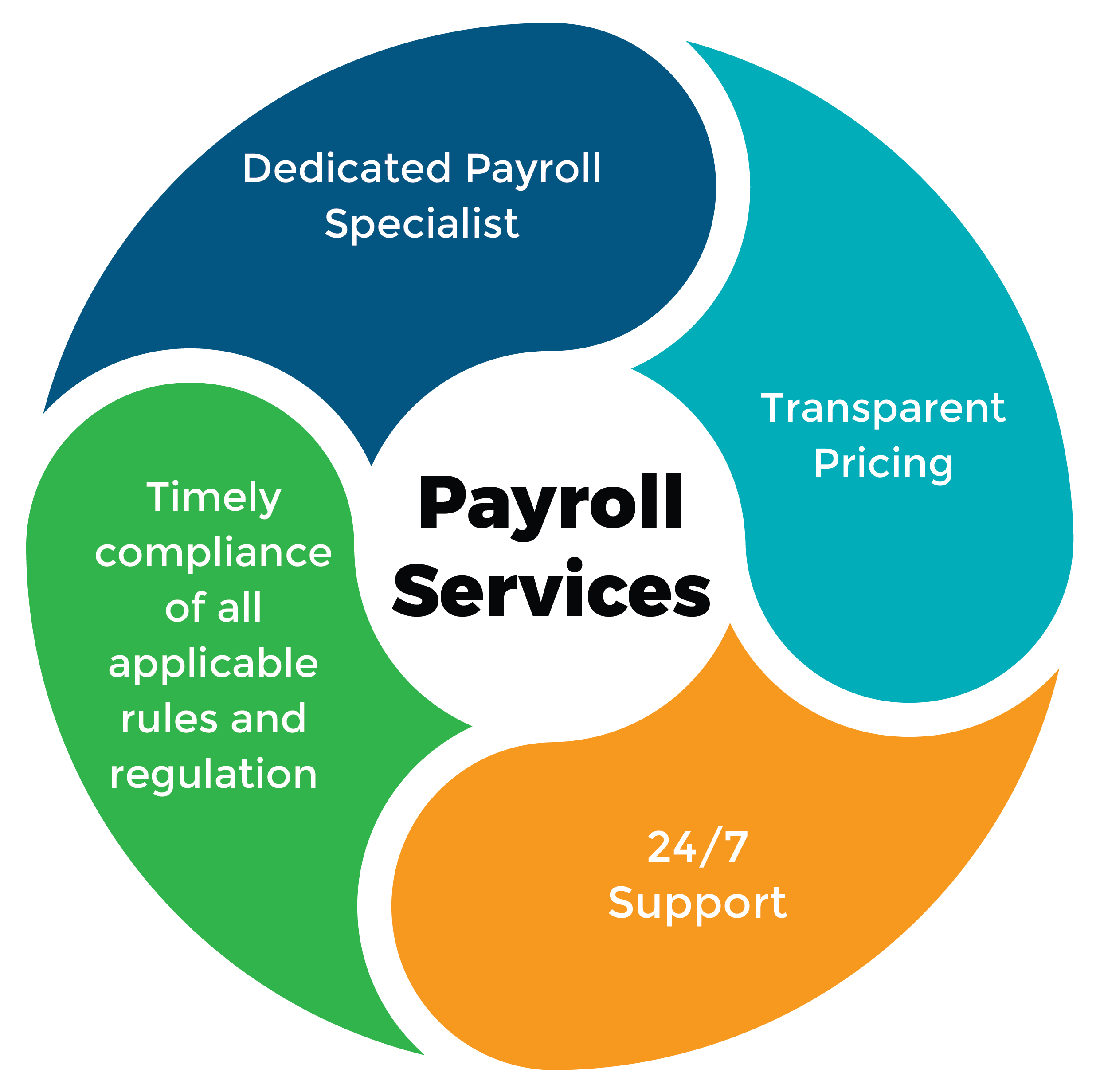

Advantages of Specialist Pay-roll Providers

Navigating payroll compliance for specialist services organizations can be significantly structured with the usage of professional pay-roll solutions, providing a range of advantages that improve efficiency and precision in managing payroll procedures. One essential advantage is proficiency (Best payroll services in Singapore). Specialist pay-roll service carriers are well-versed in the intricacies of pay-roll policies and can make certain compliance with ever-changing regulations and tax obligation requirements. This experience lowers the danger of penalties and mistakes, conserving useful time and sources for the organization.

An additional advantage is the automation and combination capacities that professional payroll services use. By automating regular tasks such as determining reductions, wages, and taxes, organizations check my reference can enhance their pay-roll procedures and decrease the potential for mistakes. Integration with other systems, such as audit software application, additional boosts efficiency by eliminating the need for manual data entry and reconciliations.

Furthermore, professional payroll services supply safe and secure information monitoring and discretion. They utilize durable protection actions to protect sensitive staff member details, lowering the threat of information breaches and making sure compliance with data protection regulations. Overall, the advantages of specialist payroll solutions add to set you back financial savings, accuracy, and assurance for specialist solutions organizations.

Conclusion

To conclude, specialist pay-roll services play a vital function in guaranteeing regulatory adherence and decreasing compliance risks for organizations. With their know-how in tax obligation laws and continuous monitoring of labor regulations updates, they give important support in browsing the complexities of pay-roll compliance. By delegating pay-roll obligations to professional solutions, companies can concentrate on their core operations while keeping legal conformity in their payroll procedures.

To reduce conformity dangers effectively in expert solutions organizations, thorough audits of pay-roll processes and paperwork are important.Browsing payroll conformity for professional services organizations can be significantly structured through the use of professional payroll solutions, offering a variety of advantages that boost performance and accuracy in taking care of pay-roll procedures. Expert pay-roll solution suppliers are well-versed in the ins and outs of pay-roll regulations and can make sure conformity with ever-changing regulations and tax demands. On the whole, the advantages of professional pay-roll solutions add to cost savings, accuracy, and peace of mind for expert solutions companies.

By turning over pay-roll responsibilities to professional services, companies can concentrate on their core Homepage procedures while keeping lawful compliance in their payroll processes.

Comments on “Leading Advantages of Choosing the Best Payroll Services in Singapore for Your Company”